MUSD just got a new superpower ⚡️

With loops, you can put your $MUSD and @SolvProtocol deposits to work in multiple ways at once. Earn yield, boost liquidity, and unlock capital.

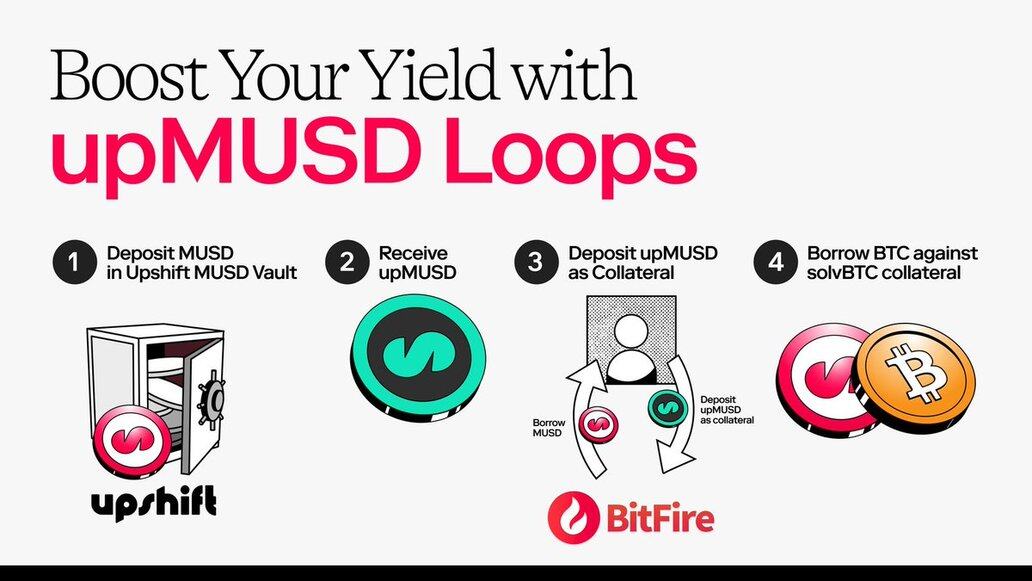

We breakdown two looping strategies, powered by @bit_fire_🧵🔽

What Are Yield Loops? ➰

Looping is a DeFi strategy that involves recursively depositing and borrowing against your assets to amplify yields. Think of it as putting your money to work in multiple places at once, earning vault yields, pool fees, and capturing interest rate arbitrage opportunities simultaneously.

Strategy 1️⃣ The upMUSD Native Loop

The math is compelling: with Upshift Vault yielding approximately 15% APY and BTC borrowing costs at just 1%, you're capturing a significant spread.

Note: Early depositors get the best yield!

@bit_fire_ @upshift_fi Strategy 2️⃣ The solvBTC Power Play

We're offering gas rebates for ALL solvBTC transactions so put your assets to work!

Note: solvBTC will need to receive BTC from our rebate program to transact. The rebate will be sent out in batches, effective immediately.

2.92K

38

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.